|

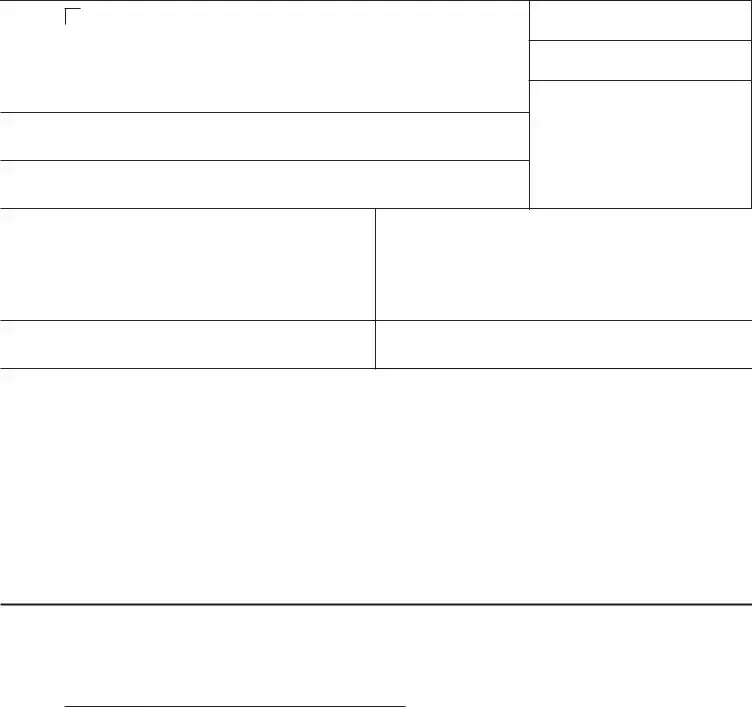

Department of Revenue Services |

REG-15 |

|

State of Connecticut |

|

PO Box 2937 |

Alcoholic Beverages Tax |

|

Hartford CT 06104-2937 |

|

|

|

Rev. 06/05 |

Application For |

|

Small Winery Certificate |

|

|

(Request for Reduced Alcoholic Beverages Tax Rate on Certain Sales

by Licensed Distributors of Wine Produced by Persons Issued a Small Winery Certificate)

Conn. Gen. Stat. §12-435(g)

Please complete this application and return it to the Department of Revenue Services (DRS) at the address shown above.

Please correct name and address if shown incorrectly

Name(s) of Owner(s), Name(s) of Partner(s) or Corporate Name |

Business Telephone Number of |

|

Owner or Partner |

|

( |

) |

Trade / Registered Name (If Different From Above)

Federal Employer Identification Number

Connecticut Tax Registration Number

Type of Organization:

Corporation |

S Corporation |

Sole proprietorship

Partnership

Limited liability company

Other

Physical Location of This Business (PO Box is not acceptable)

Business Mail Address (If different from physical location of business)

Are you licensed with the Connecticut Department of Consumer Protection, Division of Liquor Control, to distribute alcoholic beverages in Connecticut?

No |

Yes If yes, list your Permit No._________________ |

Purpose: Form REG-15 is an application for a Small Winery Certificate. Any winery that produced not more than 55,000 wine gallons of wine during the preceding calendar year can apply for a Small Winery Certificate. If DRS grants your application, we will issue you

aForm OR-267, Small Winery Certificate.

A licensed distributor of alcoholic beverages is subject to the Connecticut alcoholic beverages tax at the rate of 15¢ per wine gallon (rather than the regular rate of 60¢ per wine gallon) if:

•The licensed distributor is selling still wine that contains not more than 21% of absolute alcohol by volume; and

•The still wine is produced by a winery with a Small Winery Certificate.

Still wine contains not more than 0.392 of a gram of carbon dioxide per hundred milliliters of wine. (Alcoholic cider is a still wine if it contains not more than 0.392 of a gram of carbon dioxide per hundred milliliters of wine.)

Form REG-15 expires annually on June 30 and is renewable only if you file another REG-15.

If you have any questions, call the Excise/Public Services Taxes Subdivision at 860-541-3225, Monday through Friday, 8:00 a.m. to 5:00 p.m.

Declaration: I declare, under the penalty of false statement, that I have examined this application, REG-15, and to the best of my knowledge and belief it is true, complete, and correct. The applicant named above produced not more than 55,000 wine gallons of wine during the preceding year. I understand that the penalty for willfully delivering a false application to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Name of Winery

By: __________________________________________________________ |

______________________________________ |

Name of Owner or Authorized Agent (Print or Type) |

Title (Print or Type) |

__________________________________________________________ |

______________________________________ |

Signature of Owner or Authorized Agent |

Date |